The Corporate Sustainability Reporting Directive (CSRD), recently approved by the European Parliament, is set to bring significant changes to sustainability reporting practices. The CSRD aims at ensuring harmonization and consistency in sustainability reporting across the European Union. The new directive requires companies to provide more detailed and comprehensive information on sustainability-related matters, with a focus on environmental, social, and governance (ESG) issues.

To enable a smooth transition, the European Commission has developed an implementation timeline outlining the various steps companies need to take towards full compliance. However, many businesses are struggling to stay ahead of the game, particularly since the requirements go beyond compliance with the existing regulations.

To navigate this new reporting landscape successfully, companies should start without delay and develop a roadmap for the necessary changes. This article aims to help businesses understand the CSRD implementation timeline, the steps required for full compliance, and the benefits of going beyond compliance to embrace sustainability fully.

What is the EU Corporate Sustainability Reporting Directive (CSRD)?

The EU CSRD is a regulatory instrument adopted by the European Union (EU) that aims to establish a harmonized and consistent regulatory framework for sustainability reporting by companies. The CSRD, came into effect in 2023, will replace the existing Non-Financial Reporting Directive (NFRD). The new directive aims to improve the quality and comparability of sustainability reporting. It mandates companies to disclose material sustainability information, following a double materiality assessment process, in order to enhance their Environmental, Social, and Governance (ESG) performance reporting. It is important to note that companies reporting against the CSRD must also align with the EU taxonomy in their environmental disclosures.

The CSRD will introduce several changes, including new reporting requirements, the use of European Sustainability Reporting Standards (ESRS), and mandatory tagging of reported information using reporting standards and frameworks and mandatory independent assurance. By imposing stricter sustainability reporting rules on companies, the EU aims to increase transparency, facilitate informed decision-making, and contribute to a more equitable and sustainable economy. Investors and stakeholders will benefit from the increased disclosure of ESG data, which will allow for more accurate risk assessment and better monitoring of corporate sustainability practices.

The CSRD reflects the EU’s commitment to promoting responsible business practices and accelerating progress towards a more sustainable future.

Which companies will the CSRD apply to?

The CSRD was adopted in 2022 and took effect in 2023, with reporting requirements for companies starting in 2025 for FY 2024.

Different types of companies operating in Europe will be subject to the CSRD. Large companies will be the first group to report against the CSRD. Next, the CSRD will extend to small and medium-sized companies (SMEs) including (re)insurance companies and small and non-complex institutions, although they may face reduced reporting requirements compared to larger companies. In addition, non-European companies that operate in the EU and meet certain criteria will also be required to comply with the CSRD.

The CSRD will be implemented alongside the NFRD, or Non-Financial Reporting Directive, until it is superseded by the CSRD. Overall, the CSRD aims to improve transparency and accountability among companies’ ESG practices, ultimately promoting sustainable development in the EU.

CSRD Timeline: When Does the CSRD Take Effect for Different Types of Companies?

The CSRD lays out a clear and definitive timeline for its implementation, which we will navigate through in this section.

Firstly, EU Member States are obligated to incorporate the necessary laws, regulations, and administrative provisions into their national legal frameworks to conform with the directive by 6 July 2024. This step forms the foundation for the subsequent phases of the CSRD’s implementation. It is essential for Member States to communicate the text of these measures promptly to the European Commission, ensuring that everyone is on the same page moving forward.

Phase 1: Large Public-Interest Entities with more than 500 employees

The first phase of the timeline is marked by the commencement of the financial year on 1 January 2024. From this point onwards, the directive applies to large undertakings and parent undertakings of a large group, within the context of Article 3(4) of Directive 2013/34/EU (see picture below). This group of companies is already subject to the NFRD. They will apply the CSRD and ESRS to start reporting in 2025 for FY 2024.

Phase 2: Extension to Other Large Undertakings

As we move forward in time to financial years beginning on or after 1 January 2025, the CSRD widens its umbrella. This phase includes large undertakings and parent undertakings of a large group, as per Directive 2013/34/EU, not previously covered. These entities also need to step up and align their reporting practices with the directive. This group will apply the CSRD and ESRS to start reporting in 2026 for FY 2025.

Phase 3: Embracing Small and Medium-Sized Undertakings

The next phase kicks in from the financial years starting on or after 1 January 2026. At this juncture, the CSRD’s requirements extend to small and medium-sized undertakings, public-interest entities, small and non-complex credit institutions, as well as captive insurance undertakings. This phase signifies a pivotal point, as the CSRD’s scope broadens to cover a more diverse range of business entities. This group will report against the CSRD in 2027 for FY 2026.

Group 3 companies include different sub-groups. Please consider the below definitions.

Phase 4: Inclusion of Third-Country Undertakings

Finally, the directive extends its reach to third-country undertakings, or non-European companies, meeting certain criteria (see picture below), coming into effect for financial years beginning on or after 1 January 2028. This final phase of the timeline ensures that all relevant entities, regardless of their location, follow the same high standards of sustainability reporting. This group will report against the CSRD in 2029 for FY 2028.

Ensuring Clarity and Alignment: The Role of Member States

As EU Member States adopt these measures, they are required to refer to the CSRD during their official publication, either by including a reference or accompanying the measures with such a reference. This step is crucial in ensuring clarity and alignment with the directive across the EU.

Additionally, Member States are obliged to communicate the main provisions of their national laws adopted in the field covered by the CSRD to the Commission. This further supports transparency and allows for a smoother, more unified implementation process.

Which sustainability reporting standards will apply?

The sustainability reporting landscape is changing as the CSRD takes effect in 2023. The CSRD expands on current disclosure requirements, mandating that companies report on a broader range of environmental, social, and governance (ESG) issues. Under the CSRD, companies operating in the EU, except macro undertakings, will be subject to the European sustainability reporting standards (ESRS), including the preparation of an entity-specific disclosures and mandatory reporting on the sustainability matters of the business. These sustainability matters cover how companies manage risks, pursue opportunities and manage their impact on people and the environment.

European Financial Reporting Advisory Group (EFRAG) will set the standards and build upon existing frameworks such as the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), and Task Force on Climate-related Financial Disclosures (TCFD).

The first set of 12 draft ESRS standards was published in November 2022 and is expected to be adopted by the EC by 30 Jun 2023. Standards for SMEs, non-European companies, sector standards, and assurance standards will be published in the future.

Key Challenges of CSRD Implementation

Companies’ reports must be audited to ensure their accuracy and completeness. As the implementation date approaches, companies will need to adjust their reporting requirements to meet the new standards and ensure they have robust systems in place to collect, manage, and disclose their ESG performance.

Implementing the Corporate Sustainability Reporting Directive (CSRD) presents various obstacles for companies. Challenges include:

- Data Availability and Quality: Ensuring consistent measurement and reporting of all necessary sustainability data can be challenging, especially for SMEs.

- Adapting to New Reporting Requirements: The CSRD expands upon non-financial reporting requirements, posing challenges for companies to adjust their reporting systems and processes, especially if sustainability was not previously integrated.

- Complexity of Standards: Complying with various standards and frameworks, including the detailed ESRS requirements, can be complex.

- Training and Competency Development: Companies may lack knowledge and understanding of the CSRD, necessitating investment in training and development to equip staff to handle directive requirements.

- Assurance Services: The CSRD mandates assurance over reported information, making it challenging for companies to find suitable and cost-effective assurance services.

- Integration with Business Strategy: Embedding sustainability into core business strategy is essential for CSRD compliance and genuine, effective sustainability efforts. Such integration may face resistance within organizations as it requires significant shifts.

- Engaging Stakeholders: Effective establishment and reporting of stakeholder engagement, as required by the CSRD, can be challenging, particularly if stakeholder engagement was not previously emphasized.

- Third-Country Undertakings Compliance: Non-EU entities (third-country undertakings) encounter challenges understanding and complying with the CSRD due to differing regulations in their home countries.

Successfully implementing the CSRD requires overcoming these challenges, which may vary in intensity based on company size, resources, and prior sustainability efforts.

Your Next Steps With CSRD and ESRS Sustainability Reporting

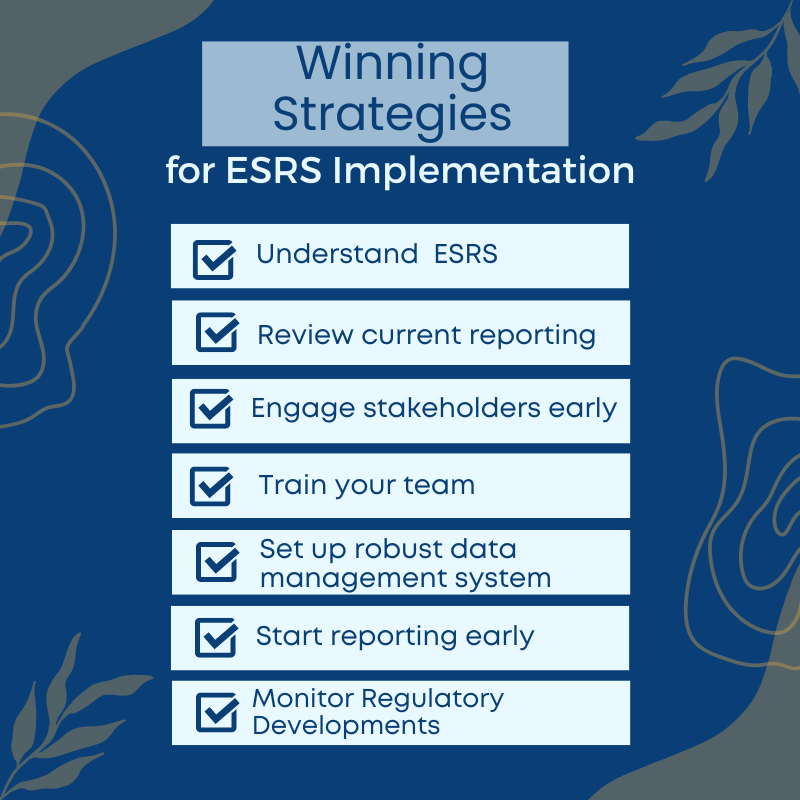

Taking action now is vital in positioning your company for a future defined by sustainability. Begin by acquainting yourself and your team with the CSRD and ESRS reporting requirements without delay. Knowledge is the cornerstone of effective compliance and strategic advantage in this new landscape.

We understand that it may seem a daunting task, but don’t worry – you’re not alone. To facilitate your understanding, we’ve compiled a wealth of resources available on The CSRD Compass website. From in-depth guides to explanatory articles and from comprehensive courses to expert analyses, The CSRD Compass is your one-stop hub for all things related to CSRD and ESRS. So, let’s embark on this journey of sustainability reporting together, future-proof your business, and make a positive impact on our world.

Your first step starts here, with the CSRD Compass.