In the realm of sustainability reporting, there has been a significant shift in the European business landscape. The European Sustainability Reporting Standards (ESRS) are creating waves as a new framework, presenting both opportunities and challenges for companies. These standards have implications that transcend traditional reporting boundaries, extending into the core of business operations and strategic planning.

As we explore the ESRS in this article, we will delve into its potential benefits and challenges for reporting companies. The intention is to inspire a holistic understanding that enables businesses to effectively navigate the ESRS landscape, turning potential challenges into tangible opportunities.

Understanding European Sustainability Reporting Standards

The European Sustainability Reporting Standards (ESRS), an initiative of the European Union (EU), are designed to enhance transparency in sustainability reporting. This comprehensive framework advances reporting practices by providing guidelines for organizations to effectively report on their ESG performance, harmonizing practices across EU member states.

The ESRS is a product of the EU’s commitment to the European Green Deal and ambition to be the first climate-neutral continent by 2050. Recognizing the necessity for a unified sustainability reporting framework, the European Financial Reporting Advisory Group (EFRAG) and its Technical Expert Group (TEG) developed the ESRS to facilitate a transition towards a more sustainable economy.

Designed to align with global reporting frameworks such as the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB), the ESRS ensures compatibility for international comparisons, while considering the unique needs of the European market, regional regulations, societal expectations, and EU policy objectives.

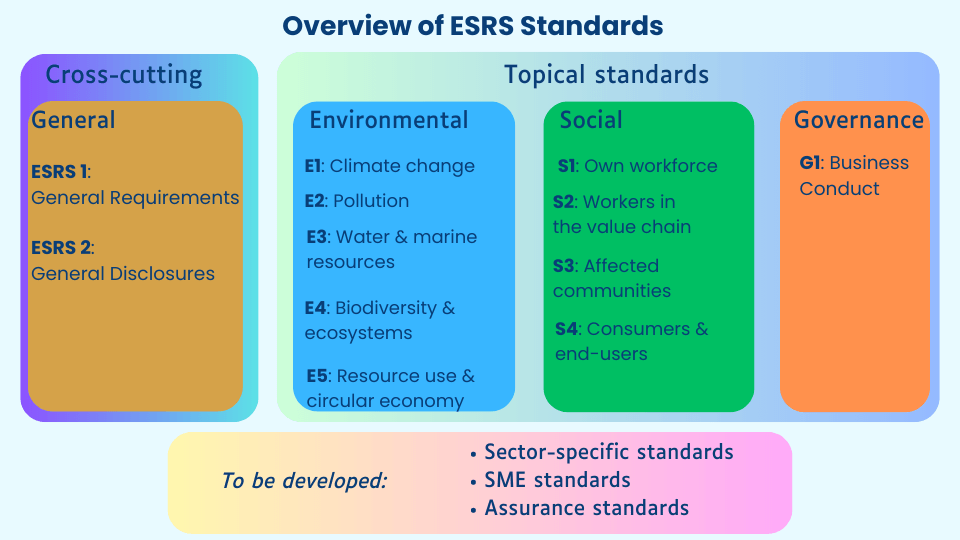

Adopting the ESRS offers a standardized approach for companies operating within the EU, enabling them to cater to the information needs of investors and other stakeholders. It covers areas such as climate change, biodiversity, human rights, labor practices, supply chain management, and anti-corruption measures. Furthermore, it establishes clear disclosure requirements and promotes the use of quantitative indicators and KPIs, enhancing the credibility and reliability of sustainability reports.

In addition to disclosing both positive and negative impacts, companies are expected to conduct a double materiality assessment process to identify key ESG factors to report on. The ESRS standards guide companies to report on relevant impacts, risks and opportunities, including value chain information.

The initial set of 12 ESRS standards, published in November 2022 by EFRAG, detail various disclosure requirements for sustainability matters. Implementing these standards successfully demonstrates a company’s compliance with the Corporate Sustainability Reporting Directive (CSRD). The first set of standards is expected to be adopted by the European Commission by 30 June 2023, with additional standards for SMEs, sector-specific standards, and standards for non-European companies being developed in the future.

If you prefer to watch visual content over reading the blog, check out our summary video:

The Opportunities Presented by European Sustainability Reporting Standards (ESRS)

1. Increased Transparency and Trust

The ESRS provides a systematic and standardized approach to reporting sustainability practices and impact.

This increased transparency can foster greater trust between companies and stakeholders, including investors, customers, employees, and the community at large. With a unified standard, corporations can communicate their commitment to sustainable practices more effectively, bolstering their corporate image and reputational capital. This requires companies to upgrade their current reporting process to ensure that their reports meet reporting requirements in the new standards.

2. Enhanced Decision-Making and Strategic Planning

Adopting the ESRS can provide companies with a better grasp of their sustainability performance, informing their strategic decision-making processes.

It enables a thorough understanding of the environmental, social, and governance aspects of the business, paving the way for more sustainable practices. Consequently, corporations can identify areas of improvement and devise strategies that not only enhance their sustainability performance but also align with their overall business objectives.

3. Risk Management and Compliance

By complying with the ESRS, corporations can mitigate risks associated with non-compliance, including legal and reputational risks. Furthermore, ESRS compliance can lead to better risk management by revealing potential environmental and social risks that corporations may face in the future. Thus, ESRS reporting can act as a tool to foresee and manage these risks proactively.

It is important to note that th ESRS is not only applicable to large companies as its scope has expanded beyond the scope of the non-financial reporting directive (NFRD). According to the CSRD, companies covered under this framework include large companies, small and medium-sized companies, non-European companies.

4. Competitive Advantage

In today’s market, sustainability is more than just a buzzword; it’s a critical factor that can set a company apart from its competitors. By adhering to ESRS, corporations can demonstrate their commitment to sustainability, which can translate into a significant competitive advantage, particularly with growing investor and consumer interest in ESG issues.

Potential Challenges of European Sustainability Reporting Standards (ESRS) for Companies

While the opportunities are immense, ESRS also poses certain challenges to corporations.

1. Adaptation and Implementation

One of the significant challenges lies in adapting to the ESRS framework and implementing it within the corporation’s existing reporting structure. This can be a daunting task, particularly for corporations that previously have not been required to report sustainability information or those using different reporting standards.

2. Cost Implications

Compliance with the ESRS may involve initial and ongoing costs. This can include the costs associated with training staff, upgrading data collection and management systems, and the time and resources spent preparing and auditing reports. For smaller corporations and those with tighter budgets, these costs may pose a substantial challenge.

3. Data Collection and Reporting

Effective ESRS reporting requires a robust data collection and management system. Corporations may face challenges in gathering the necessary data, especially regarding their environmental and social impacts. There may also be concerns about data privacy and protection, particularly when dealing with employee-related data.

Overcoming Challenges to Leverage Opportunities

The challenges associated with ESRS should not be perceived as roadblocks but as prompts for innovation and improvement. Here are a few ways to navigate these challenges:

1. Building Capacity

It is crucial to invest in capacity building, including staff training and development, to ensure a smooth transition to ESRS compliance. This could involve hiring sustainability experts or providing existing staff with relevant training.

2. Leveraging Technology

Technology can significantly streamline the process of data collection, management, and reporting. Advanced data analytics tools, for instance, can automate data collection, ensuring accuracy and saving valuable time and resources.

3. Strategic Planning

An effective strategic plan can serve as a roadmap for ESRS compliance. It should outline the steps needed to incorporate the ESRS into the existing reporting structure, manage data collection, and align sustainability reporting with broader business goals.

In conclusion, while the ESRS presents some challenges for corporations, it also offers considerable opportunities. The key to leveraging these opportunities lies in understanding the ESRS requirements, effectively managing the challenges, and aligning sustainability reporting with broader business goals. The ESRS, therefore, should not be seen as merely a compliance requirement but as a strategic tool that can enhance business value, foster stakeholder trust, and drive sustainable growth. With the right approach, the ESRS can indeed be a transformative force in the corporate world.

Supporting Resources from The CSRD Compass

Did you know that The CSRD Compass provides a valuable resource for companies seeking to achieve full compliance with the CSRD? Our free comprehensive CSRD course outlines ten essential steps that organizations can follow to ensure adherence to the CSRD requirements. Take a look at this website to access this invaluable resource and navigate the complexities of sustainability reporting effectively.

Don’t miss out on this chance to expand your expertise in sustainability reporting. Take advantage of these courses provided by The CSRD Compass and empower yourself to drive positive change within your organization.