In today’s rapidly evolving business landscape, sustainability reporting is more than just a corporate social responsibility (CSR) initiative. It is an opportunity for businesses to articulate their social, environmental, and governance (ESG) commitments, strategies, and impacts to various stakeholders.

The European Union’s Corporate Sustainability Reporting Directive (CSRD), replacing the Non-Financial Reporting Directive (NFRD), takes a leap forward in standardizing and improving the consistency and comparability of ESG reporting across Europe. This directive is a clear message to corporations that the EU is serious about fostering transparency and accountability, but it also presents significant challenges for businesses to comply with its stringent standards.

To align with the CSRD, companies need to understand the gaps in their current ESG practices and reporting processes. This can be achieved by conducting a gap analysis—an effective tool that identifies discrepancies between current practices and regulatory requirements. Let’s delve into the steps of how to conduct a gap analysis for CSRD compliance.

Understanding the CSRD

Before starting the gap analysis, it is essential to understand the scope of CSRD. This directive requires large companies and all publicly listed entities in the EU, along with financial and non-financial sector entities, to provide comprehensive information on their sustainability performance. The areas covered include environmental, social and employee matters, human rights, anti-corruption, and bribery issues.

The CSRD not only increases the number of companies required to disclose their ESG information but also enhances the quality of the data reported. Companies are required to report information in a reliable and comparable manner according to mandatory EU sustainability reporting standards.

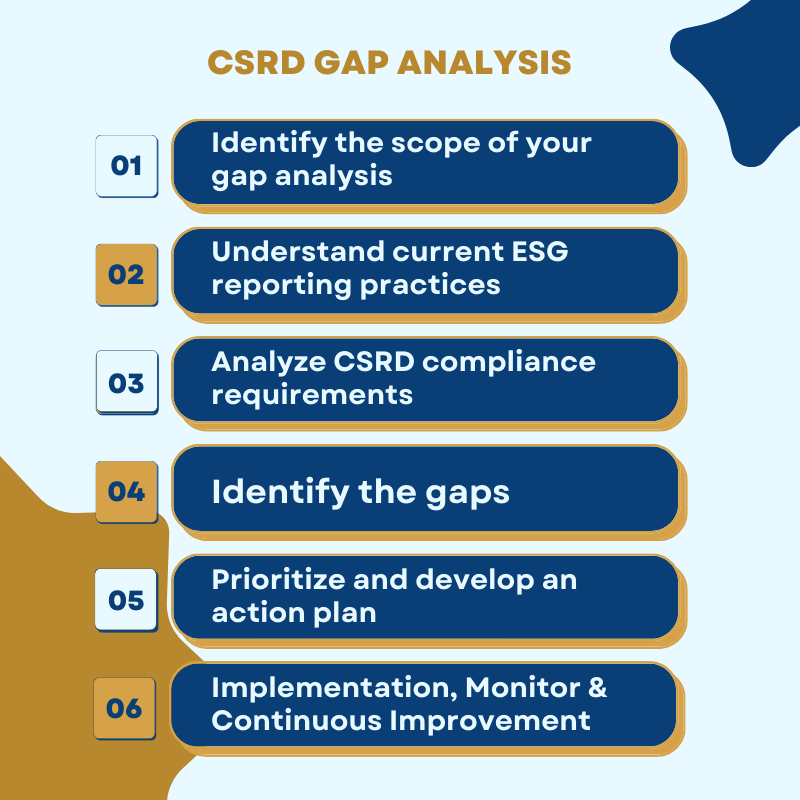

Conducting a CSRD Gap Analysis for Full Compliance

Here are key steps that your team can perform to identify the gaps before starting the CSRD implementation.

Step 1: Identify the Scope of Your Gap Analysis

The first step in a gap analysis for CSRD compliance involves clearly identifying the scope of your analysis. This could include multiple departments across your organization, or multiple locations in a consolidated reporting scenario. This is because ESG responsibilities often cut across many different areas of business operations, and potentially across different countries and/or sites. Depending on your current reporting process, you may need to include departments such as finance, HR, procurement, operations, and risk management.

Step 2: Understand Current ESG Reporting Practices

After defining the scope, conduct a comprehensive review of your existing ESG reporting processes. This step requires a deep dive into your existing reporting framework and data sources, the kind of ESG data you currently collect, how the data is verified and who is involved in the process. It would also be beneficial to evaluate any external ESG communication and disclosure practices.

It is important to develop a deep understanding of double materiality assessment in this step, as this process will identify disclosures that companies must report on to meet the reporting requirements in the European Sustainability Reporting Standards (ESRS).

Step 3: Analyze CSRD Compliance Requirements

The next step is to thoroughly analyze and understand the CSRD compliance requirements. These requirements are broad, encompassing a range of ESG metrics and reporting standards. Understand what metrics are mandatory, how they should be calculated, and what processes need to be in place for data verification and assurance. CSRD also requires that companies disclose their direct and significant indirect impacts.

To find out more about ESG metrics in CSRD reporting, take a look at our blog “CSRD: Intepreting ESG Metrics“.

Step 4: Identify the Gaps

With a clear understanding of both your current ESG reporting practices and CSRD compliance requirements, you can now identify the gaps. These might include lack of certain data, inconsistencies in data collection, lack of robust verification methods, or absence of necessary reporting processes or structures.

Step 5: Prioritize Actions and Develop an Action Plan

Upon identifying the gaps, the next step is to prioritize actions based on risk and impact. It’s unlikely you will be able to address all gaps at once, so focus on high-risk and high-impact areas first. Developing an action plan will help you strategically address the gaps and improve compliance over time. This plan should include clear steps, timelines, assigned responsibilities, and resources required for implementation.

Step 6: Implementation, Monitoring and Continuous Improvement

Implement the action plan, monitor progress, and adjust as necessary. CSRD compliance is not a one-time event but a continuous process of improvement. It’s important to create a culture of transparency, accountability, and continuous learning within the organization. Ensure to periodically review your progress and update your action plan as required.

Conclusion

Complying with the CSRD is a substantial task but also an opportunity for companies to enhance their ESG strategy, strengthen stakeholder trust and advance towards sustainable growth. A thorough gap analysis is a critical starting point in this journey. With the right approach, organizations can transition smoothly towards full CSRD compliance, turning a regulatory obligation into a strategic advantage.

Remember, CSRD compliance is not just about ticking boxes, it’s about truly embedding sustainability into the core of your business. The right preparation and strategic planning can turn this directive into an opportunity to showcase your company’s commitment to ESG matters, which can ultimately lead to improved reputation, investor confidence, and business performance.