Introduction

ESG Risk – the environmental, social, and governance (ESG) issues that can significantly impact a company’s financial performance and reputation – is a prominent subject in today’s business landscape. From financial institutions to supply chains, ESG risks have made their mark, shifting the way businesses operate and investors assess potential opportunities.

This blog post will delve into the world of ESG risk, discussing its importance, the benefits of mitigation, the different types of ESG risks, and effective strategies for managing these risks and opportunities. We will also touch on the critical topic of CSRD (Corporate Sustainability Reporting Directive) Compliance.

Understanding ESG Risk

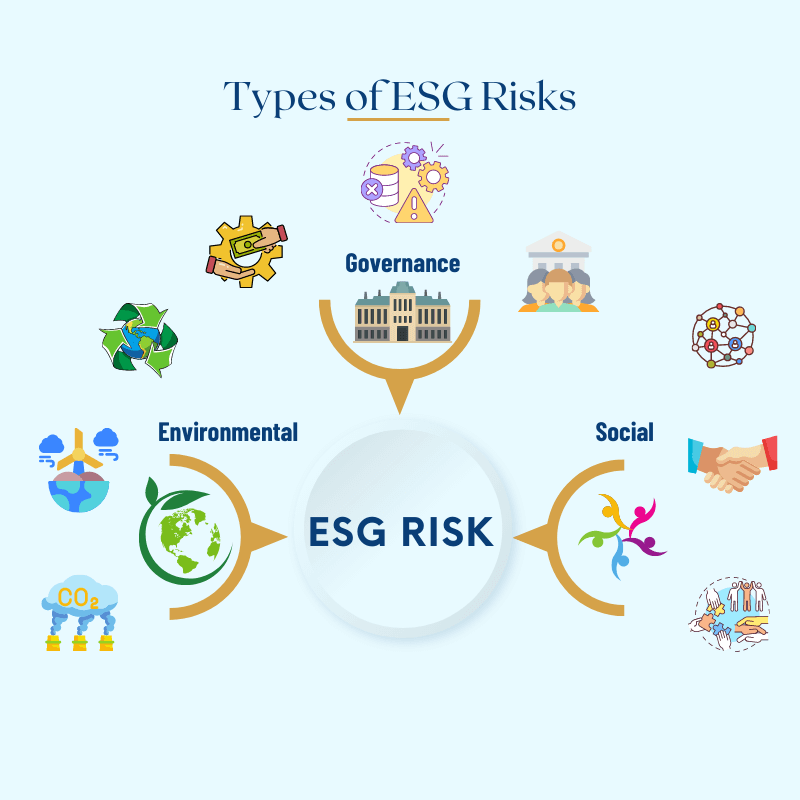

Environmental, social, and governance (ESG) risk refers to the potential negative impacts on a company’s operations and value due to ESG factors. These risks include environmental impacts such as climate change and extreme weather events, social issues like human rights, health and safety or labor rights, and governance concerns revolving around corporate structure and executive compensation.

Companies and investors use ESG risk assessment to identify, measure, and manage ESG-related risks. This assessment evaluates the organization’s exposure to ESG risks, their potential impact, and the company’s ability to mitigate these risks.

The Importance of ESG Risk

Why should businesses care about ESG risks? The reason is simple: ESG risks can directly affect an organization’s long-term value and financial performance. For instance, the Covid-19 pandemic, an example of a social risk, has severely disrupted supply chains and business models, leading to significant financial loss for many companies.

Moreover, ESG risks, such as those related to climate change or poor governance, can also tarnish a company’s reputation, damaging its ability to attract investors, customers, and talent. Finally, regulatory bodies worldwide are increasingly mandating ESG risk disclosure and transparency, making it a compliance issue for corporations.

Types of ESG Risks

Environmental Risks

These are risks related to the natural environment and include climate-related risks, waste management issues, and risks associated with transitioning to a low-carbon economy. For instance, extreme weather events can disrupt a company’s operations or supply chain.

Social Risks

These include risks related to the workforce and community, such as health and safety concerns, humanrights violations, and the consequences of a pandemic.

Governance Risks

Governance risks pertain to the way a company is run. These risks include executive compensation issues, corruption, lack of board diversity, and poor management systems.

Mitigating ESG Risks

Implementing a robust ESG risk management framework helps mitigate ESG risks and creates long-term value. It also aligns the company with sustainable business practices, demonstrating strong ESG credentials.

Effective ESG risk management involves a comprehensive risk assessment process, proactive stakeholder engagement, sector-specific ESG considerations, and embedding ESG factors into business processes. Financial institutions, in particular, are increasingly incorporating ESG factors into their risk management strategies to ensure better ESG performance.

A comprehensive risk assessment identifies material ESG issues and quantifies their potential impact. Stakeholder engagement helps organizations understand the ESG concerns of various stakeholders, from investors to local communities.

Incorporating sector-specific ESG considerations allows companies to assess ESG risks relevant to their industry. For instance, a pharmaceutical company will have different ESG issues compared to a technology firm.

Embedding ESG factors into business processes ensures that ESG considerations are not an afterthought but an integral part of the business.

ESG Risks and CSRD Compliance

The EU’s Corporate Sustainability Reporting Directive (CSRD) mandates companies to disclose specific ESG data, thus bringing ESG issues into the limelight. To comply with CSRD, organizations must incorporate ESG factors into their risk management framework and disclose their ESG risks and opportunities.

Companies will need to follow a detailed double materiality process to determine which ESG issues are most significant to them. This framework can guide companies towards incorporating ESG factors into their decision-making processes, developing an ESG strategy, and ultimately, achieving CSRD compliance.

Let’s explore how to identify and manage risks and opportunities in the context of CSRD.

Identifying ESG Risks

Identifying ESG risks Environmental, social, and governance (ESG) risks refer to the potential negative impacts that a company’s operations or activities may have on the environment, society, and governance practices. Here are some ways to identify ESG risks:

1. Environmental Risks: These are risks associated with a company’s environmental impact, such as pollution, greenhouse gas emissions, deforestation, and water scarcity. Some indicators of environmental risks include a company’s carbon footprint, waste management practices, and environmental policies.

2. Social Risks: These risks relate to how a company interacts with its stakeholders, such as employees, customers, suppliers, and community members. Some indicators of social risks include employee turnover, labor disputes, product safety, and customer complaints.

3. Governance Risks: These are risks associated with a company’s corporate governance practices, such as board structure, executive compensation, and shareholder rights. Some indicators of governance risks include related-party transactions, CEO turnover, and accounting irregularities.

To identify ESG risks, companies can conduct ESG assessments, engage with stakeholders, review sustainability reports, and analyze industry trends and best practices. Investors can also evaluate ESG risks by assessing a company’s ESG rankings, analyzing ESG disclosures, and conducting due diligence.

Identifying ESG risks can be complex due to their broad scope and often indirect impacts. However, it is a vital process for any company aiming to achieve CSRD compliance.

Managing ESG Risks

Once these risks have been identified, the next step is to develop strategies to manage them effectively. These strategies could involve implementing more sustainable operations, fostering a more inclusive work environment, and enhancing governance structures.

There are several steps organizations can take to effectively manage ESG risks:

1. Conduct a ESG risk assessment: See above.

2. Develop a ESG strategy: Define your organization’s ESG goals and objectives, and create a plan to achieve them. This plan should address each of the ESG risks identified in your assessment.

3. Implement ESG policies and practices: Develop and implement policies and practices to address the identified ESG risks. This might include measures like reducing greenhouse gas emissions, promoting ethical labor practices, and ensuring board diversity.

4. Monitor and measure ESG performance: Track your organization’s progress towards achieving its ESG goals, and measure the effectiveness of the policies and practices you’ve implemented.

5. Report on ESG performance: Communicate your organization’s ESG performance to stakeholders, including investors, customers, and employees. This might include an annual ESG report, sustainability reporting, or other relevant disclosures following a well-defined framework such as the CSRD/ESRS.

By following these steps, organizations can effectively manage ESG risks, improve their environmental and social impact, and enhance their long-term sustainability and viability.

Identifying ESG Opportunities

In addition to managing risks, companies must also identify opportunities that ESG presents. These opportunities could be in the form of improved brand reputation, access to new markets, increased operational efficiency, and attracting quality workforce and investors.

ESG opportunities require businesses to be proactive and innovative. Here are few steps companies can take to identify ESG opportuninites:

1. Analyze industry trends and governmental regulations: Look for emerging social, environmental, and governance trends that may impact your business, and evaluate regulations related to ESG aspects.

2. Use ESG ratings and indices: ESG ratings agencies and indices can help you identify areas where your company may excel or need improvement.

3. Conduct effective stakeholder engagements: Engage with your stakeholders, including customers, employees, investors, and communities to understand their ESG priorities, and identify opportunities to align them with your business objectives.

4. Review your supply chain: Evaluate your suppliers from an ESG perspective, and identify areas where you can improve your supply chain social, environmental, and governance practices.

5. Adopt circular economy models: Explore circular economy principles, which aim to minimize waste and maximize the value of resources, and identify areas where you can incorporate them into your operations.

6. Invest in ESG technologies: Identify ESG technologies that can help you reduce your environmental impact, improve social well-being, and enhance governance practices.

7. Review your corporate social responsibility initiatives: Review your existing corporate social responsibility initiatives and identify areas where you can expand or improve your efforts.

8. Adopt a sustainability reporting framework: Implement a sustainability reporting framework such as CSRD, GRI, SASB, or TCFD to assess and disclose your ESG performance, and track your progress over time.

Capitalizing on ESG Opportunities

Identifying opportunities is only the first step. To reap the benefits of these opportunities, companies need to develop strategic plans that align with their business goals and values.

Companies can leverage ESG opportunities to establish a competitive advantage, enhance stakeholder relations, and drive long-term profitability. This requires a deep understanding of the company’s business context, stakeholder expectations, and industry trends.

The Road to CSRD Compliance

CSRD compliance is not a one-time task. It’s a continuous process that requires companies to consistently identify, manage, and capitalize on ESG risks and opportunities. The successful implementation of these strategies can not only help companies meet their regulatory obligations but also provide them with a competitive edge in an increasingly ESG-centric business environment.

In conclusion, the importance of becoming CSRD compliant cannot be understated. By adopting a strategic approach towards identifying and managing ESG risks and capitalizing on ESG opportunities, companies can ensure a smooth transition to a more sustainable and socially responsible business model.

Remember, CSRD compliance is not just about meeting regulatory obligations, it’s about fostering a corporate culture that prioritizes sustainability, ethical practices, and inclusive governance. It’s about paving the way for a sustainable future where businesses thrive without compromising the well-being of the planet and its inhabitants.

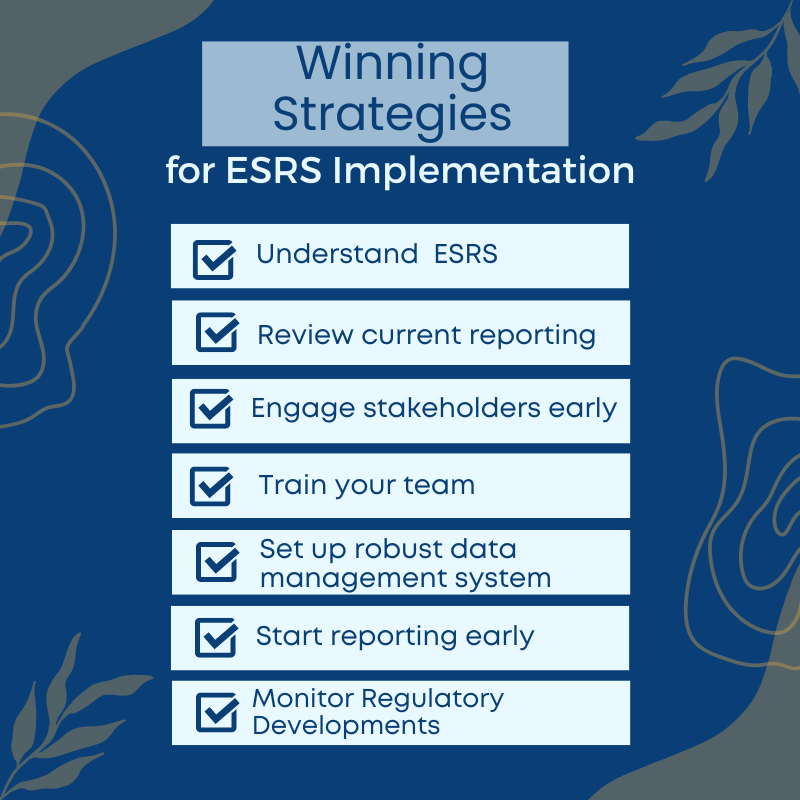

Your Next Step on the CSRD Compliance Journey

Are you ready to spearhead your company’s sustainability journey and stand out from the crowd? The Corporate Sustainability Reporting Directive (CSRD) and European Sustainability Reporting Standards (ESRS) are not only coming but are here, and your next steps are critical.

Mastering the complexities of the CSRD and ESRS can seem like a daunting task. However, overcoming this challenge doesn’t just mean compliance with new laws – it’s an opportunity to show your commitment to a sustainable future, to gain a competitive edge, and to attract stakeholders who value responsibility.

We know it might be overwhelming, but you’re not alone in this journey. Imagine having all the necessary tools, knowledge, and support at your fingertips. That’s where The CSRD Compass steps in. We’re your ultimate guide to everything CSRD and ESRS, offering a rich collection of resources ranging from detailed guides and insightful articles to comprehensive courses and expert analysis. Navigating this new terrain of sustainability reporting has never been easier!

Don’t wait for tomorrow. The time to act is now. Embark on your sustainability reporting journey today, prepare your business for a sustainable future and make a real impact on our planet. Visit The CSRD Compass today, and let’s shape a greener future together!